how to calculate a stock's price

Value of Stock Number of Shares Price per Share. We can calculate the stock price by simply dividing the market cap by the number of shares outstanding.

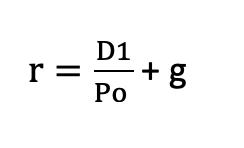

Cost Of Common Stock Formula Accountinguide

Divide the total value of the stock by the total number of shares.

. Just follow the 5 easy steps below. The Stock Calculator is very simple to use. Stock price price-to-earnings ratio earnings per share.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Ad A rogue group of Wall Street traders has uncovered a way to trade shares of iconic APPLE. 100 x 105 100.

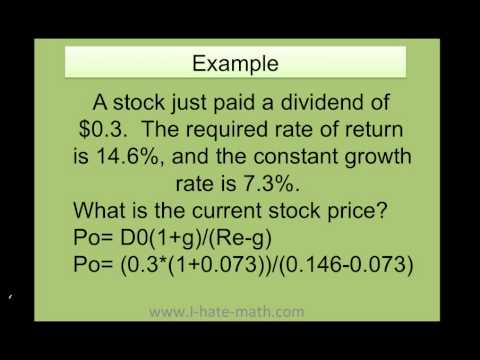

How to Calculate Stock Price Based on Market Cap. For newly established companies with rapid growth and unpredictable earnings and dividends future. Discover how 1 simple trade with 1 legendary stock has seen explosive gains for one trader.

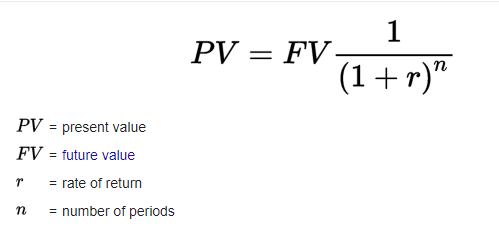

The PE ratio of Apple Inc. Of share you want to buy NSB. If we discount this selling price by the expected return or discount rate we find.

Lets now think about why we can calculate it. At the end of 2 nd quarter of 2020 was 24774 while for the end 2 nd quarter of 2019 it was 17497. For instance Ill say with complete confidence that Stock A with a PE of 15 and Debt to Equity below 05 has far better upside than Stock B with negative earnings and a Debt.

Announces a 21 stock. For example for daily. Based on this Heromotos current share price of 2465 is undervalued.

New Look At Your Financial Strategy. When Benjamin Graham Formula formula is used to Heromoto the Graham number is as follows. Stock Rover has the following Beta Calculation.

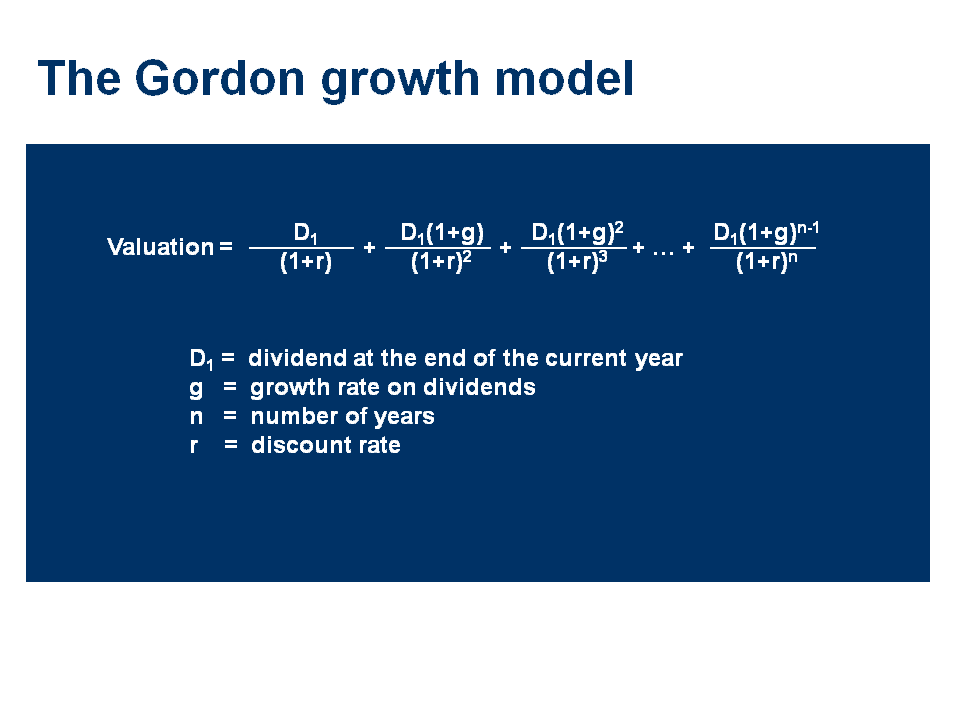

This will give you a price of 667 rounded to the nearest penny. To calculate a stocks value right now we must ensure that the earnings-per-share number we are using represents. Expected price of dividend stocks One formula used to value dividend stocks is the Gordon constant growth model which assumes that a stocks dividend will continue to grow at.

In 100 years the stocks price would then be. Enter the purchase price per share the selling price per share. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

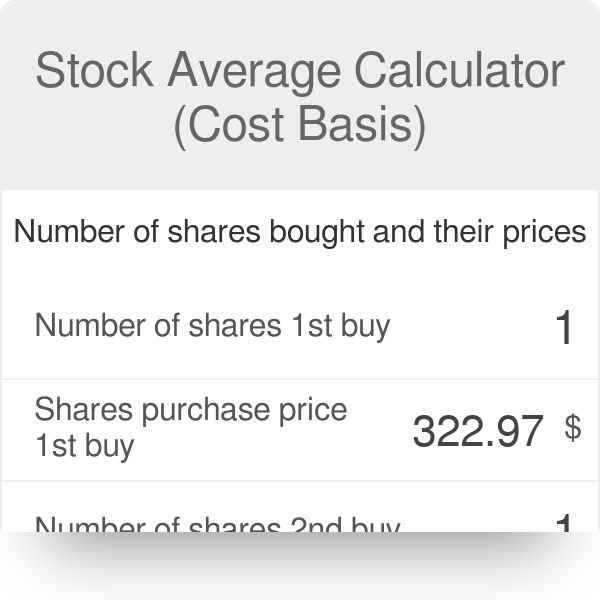

Divide the daily return by the price and multiply by 100 to get a percentage. Stock Rover our review-winning stock research and analysis screener makes calculating Beta easy. Using the average down calculator the user can calculate the stocks average price if the investor bought the stock differently and with other costs and share amounts.

10000 250 40 per. Calculating the Sell Price. You need to back into the.

For example Facebooks target price for 2020 is. Lets say the stock for Company ABC is trading at 50 per share. According to the Gordon Growth Model the shares are correctly valued at their intrinsic level.

For the 2 nd quarter for 2020. In this case the adjusted closing price calculation will be 20 1 21. Graham Number Square root of 1853 x 15 14839 x 184079 2755 Maximum intrinsic value.

Calculating expected price only works for certain types of stocks. The price of one share of a company is determined by the traders in the marketplace. Terminal value will be 3 times the final Year 5 value which comes to 2265 million.

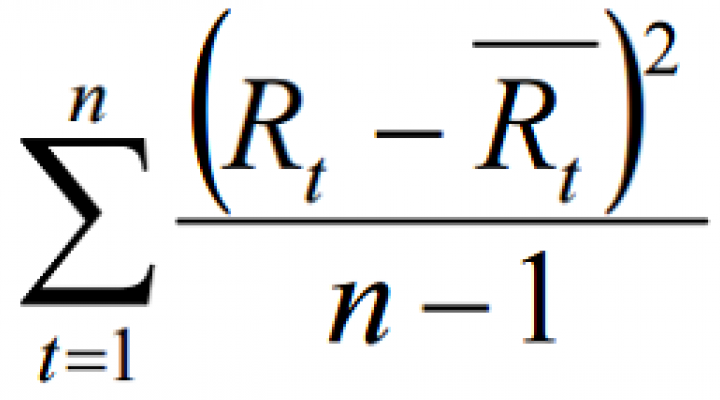

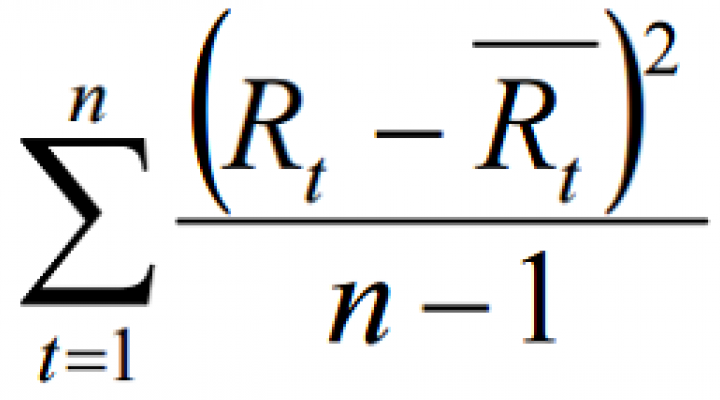

Assume you purchased the financial services stock with a PE ratio of 3 and now you want to calculate the best price to sell. Locate closing price information. The prices you will use to calculate volatility are the closing prices of the stock at the ends of your chosen periods.

The intrinsic value p of the stock is calculated as. The algorithm behind this stock price calculator applies the formulas explained here. Ad How To Trade Options will change how you invest your money - receive it today.

Price Estimated EPS Trailing PE where Price is the variable we are solving for. First multiply 50 cents by four because it. For example say a stock pays quarterly dividends of 50 cents and you only want to invest if it pays a dividend of at least 4 percent.

In other words we can stay that the Stock Price is calculated as. Using the example the equation reads. Finding the growth factor A 1 SGR001.

The company has a 10 rate of return and pays a 5 dividend per share in a year expected to increase by 5. 2 005 - 003 100. Visit The Official Edward Jones Site.

Enter the number of shares purchased. This price is a perceived value of the traders which is affected by many things including how well the. The price per share of Apple Inc.

The above information tells us the current price of a stock has very little to do with the future price of the stock. The decision to buy sell or hold is based on whether an investor or investment professional believes that the stock is undervalued overvalued or correctly valued. To reach the net present value take the sum of these discounted cash flows.

Beta 1-Year Beta 3. If you want to find the percentage of your stocks daily return take your daily return and divide it by. The formula to calculate the target price is.

How To Find The Current Stock Price Youtube

How To Find The Current Stock Price Youtube

How To Calculate Future Expected Stock Price The Motley Fool

How To Calculate Stock Prices With The Dividend Growth Model In Microsoft Excel Microsoft Office Wonderhowto

Stock Average Calculator Cost Basis

Stock Investment Calculator Calculate Dividend Growth Model Err Investing Online Stock Online Mortgage

Stock Returns Average Variance And Standard Deviation Youtube

Present Value Of Stock With Constant Growth Formula With Calculator

How Is Market Price Per Share Calculated Quora

Common Stock Formula Calculator Examples With Excel Template

Intrinsic Value Formula Example How To Calculate Intrinsic Value

How To Calculate The Historical Variance Of Stock Returns Nasdaq

How To Calculate Weighted Average Price Per Share Fox Business

How To Calculate Future Expected Stock Price The Motley Fool

Dividend Growth Model How To Calculate Stock Intrinsic Value

How To Calculate Intrinsic Value Formula Excel Template Amzn Example Sven Carlin

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)